tang90246/iStock via Getty Images

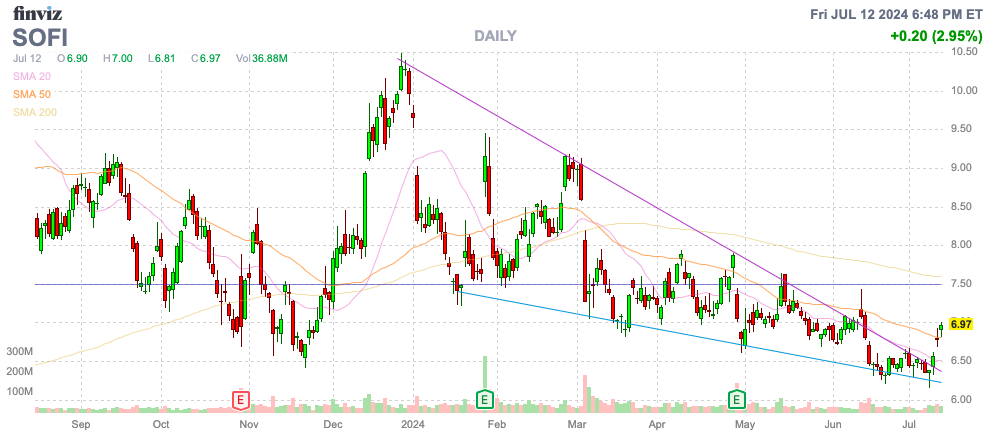

In an ironic move, SoFi Technologies (NASDAQ: SOFI) was hit with two price target cuts this week, again setting up a potential bottom for the stock. Fintech is constantly questioned about credit ratings without ever having much substance. My investment thesis remains ultra-bullish on the stock, trading at a deep discount to the possibility of future growth.

Source: Finviz

Targeted price cuts

SoFi saw the following 2 price target cuts on July 9:

- KBW cut PT from $7.50 to $7.00

- Barclays cut PT from $10.00 to $8.00

Ironically, the stock hit a low of $6.15 and immediately began trading. KBW was convinced that SoFi is facing higher loan defaults, leading to the decision to lower the price target to just $7. The analyst firm believes SoFi faces a large increase in non-performing loans leading to cumulative losses over the life of loans higher than 7% to 8% targeted my management.

At the Mizuho Technology conference on June 12, CFO Chris Lapointe was quite confident that fintech was staying within those loss targets. In fact, the CFO seems to suggest that the latest loss reports are better than those expectations:

So what I would say is what gives us confidence in that 7% to 8% loan loss rate is that we have over a decade of experience underwriting high quality loans. In addition, we are seeing really favorable trends in some of our latest batches. So I mentioned that during our first quarter earnings call. But just to give a little extra detail. If you look at our Q1 through Q3 2023 cohorts and compare that to the Q3 2022 cohort at similar levels of outstanding principal balance on the balance sheet, you’ll see that our losses in recent years are 20% to 40% better than Q3 2022. If you take that a step further and go back to 2017, the last time we saw loan losses that even came close to 8%, it was still under 8%.

Remember, SoFi focuses on student and personal loans for borrowers with high FICO scores and income. Not to mention, digital banking has recently pulled back from lending, leading to the adoption of even higher quality borrowers. The company offered corporate forecasts for 2024 based on a dire economic scenario with shrinking GDP and an unemployment rate of 5%, nor do results look credible already in the third quarter now.

CEO Anthony Noto continued CNBC the next morning after lowering the price target and again contradicted the negative view of analysts. At the Sun Valley conference, Noto claimed the bank was meeting targets and seemed to suggest SoFi was on the verge of increasing lending after the rate cut.

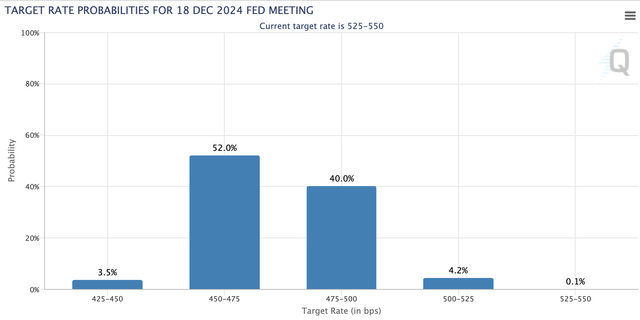

This week’s CPI increased the odds of a Fed rate cut this year. The updated forecast has a nearly 100% chance of a rate cut in September, with a 56% estimate for at least 3 rate cuts this year.

Source: CME Group

At the Mizuho Technology conference, CFO Chris Lapointe reinforced the concept of increasing lending by lowering rates:

We feel really good about the fundamental lending trends we’re seeing in our business. But from a broader macro perspective, that there is too much volatility to grow that business more than it should. What I would say is we’re still at $4.5 billion in originations per quarter of originations across the platform today, which is still quite large despite the conservative approach we’re taking. Now what would change our perspective on starting or scaling a lending business. I think the macro needs to change. We should have much better visibility. Rates should stabilize. We need to have much better visibility of what’s going on with fears of a recession, unemployment, etc., or rates will have to come down.

As much discussed by SoFi, the company is no longer so focused on lending to grow the business. Financial services revenue was $151 million in 1Q24, accounting for 26% of total revenue, but growing by 86%.

All of the growth in 2024 is related to growth in Financial Services as SoFi adds additional Members and Products. The forecast is for essentially all revenue/profit gains to come from this line of business, less impacted by the economy or interest rates and set to grow 75% for the year.

Profit machine

The confusing investment story with SoFi is that the company does not have a history of loan losses and loan appraisals that affect financials. At the same time, fintech is much more profitable than the market sees with the absurd shift to focusing on GAAP earnings.

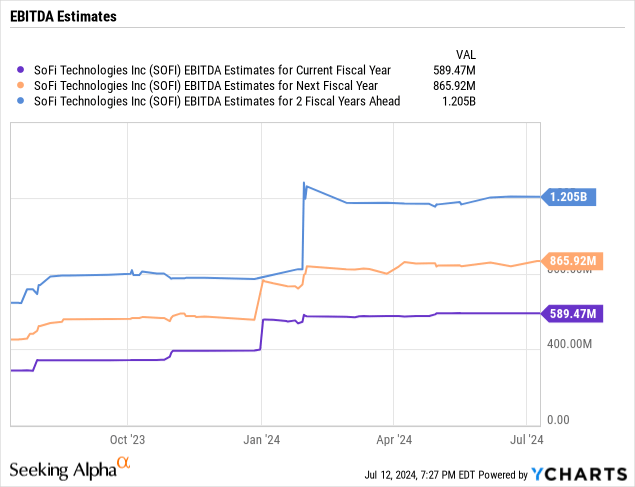

SoFi is now projected to generate $1.2 billion in adjusted EBITDA in 2026. The stock has a market cap of just $7.4 billion after the stock ended earnings last week.

The issue for most is the high stock-based compensation. SoFi has consistently reduced SBC fees since the SPAC transaction, and most adjusted EBITDA earnings now relate to GAAP earnings plus intangible amortization charges.

As repeatedly emphasized, the adjusted EBITDA figure roughly reflects an adjusted profit figure. According to consensus analyst estimates, SoFi produces adjusted EBITDA of nearly $866 million in 2025, leaving the stock at just 8.5 times adjusted earnings targets.

As the numbers get bigger and bigger, the SBC becomes a part of the profits. In Q1, SBC was down $9 million year-over-year and was less than 10% of revenue and accounted for only ~38% of the $144 million in adjusted EBITDA.

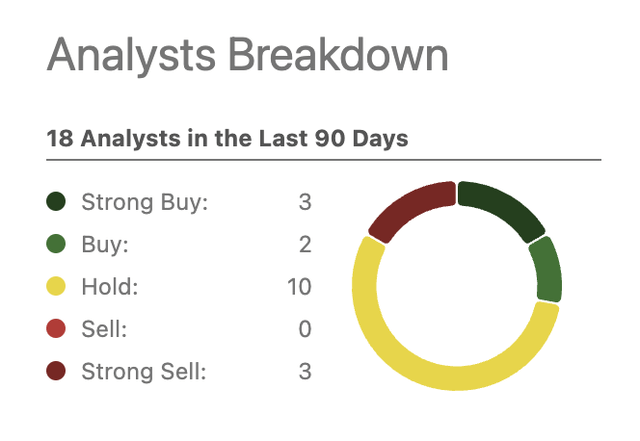

The consensus analyst view on SoFi is absurdly negative, although the average price target is 25% higher at a price target of $8.75. The average rating is still stable, with only 5 buys among 18 reviews.

Source: Seeking Alpha

SoFi has targeted revenue growth of 20% to 25% through 2026, however the average analyst has the stock trading at 8.5x 2025 adjusted EBITDA targets. Analysts have adjusted EBITDA down from $432 million generated in 2023 to updated targets to 2026, making valuation multiples virtually unheard of in the stock market.

In reality, SoFi should have the following 12-month price targets based on a 2026 adjusted EBITDA target of $1.2 billion and the above growth rates:

- 15x adj. EBITDA = $18 billion market cap, or $17 price target

- 25x adj. EBITDA = $30 billion market cap, or $29 price target

Takeaway

The main issue for investors is that analysts are fixated on SoFi’s loan loss rates, yet both the CEO and CFO have publicly stated that the company is on track to meet previous targets. In fact, analysts should be more bullish on the future, suggesting that fintech is likely to increase lending towards 2025.

Investors should continue to use the stock’s weakness to charge logical price targets well above $7.