JPMorgan Chase CEO Jamie Dimon told US lawmakers on a Senate Banking Committee that the only real use case for cryptocurrency is for criminals and said that if the government had control, he would “shut it down.”

The head of America’s largest retail bank has a warning for its 86 million customers: Prepare to pay for your bank accounts.

Marianne Lake heads Chase Bank, the sprawling franchise within JPMorgan Chase that is the nation’s largest consumer bank and one of the largest issuers of credit cards. Lake is warning that new rules that will limit overdraft and late fees will make everyday banking significantly more expensive for all Americans.

| TICKER | Safety | The last | AmENdmENT | change % |

|---|---|---|---|---|

| JPM | JPMORGAN CHASE & CO. | 204.75 | -2.79 | -1.34% |

Lake said Chase is planning to pass on higher regulatory costs and charge customers for a number of already free services, including checking accounts and wealth management tools, if the rules become law in their current form. She expects her colleagues in the industry to follow suit.

US ECONOMY ADDS 206,000 JOBS: APRIL, MONTH REVISED BELOW

MUMBAI, INDIA – MARCH 10: Marianne Lake, Global Chief Financial Officer of JP Morgan, pictured on March 10, 2014 in Mumbai, India. ((Photo by Abhijit Bhatlekar/Mint via Getty Images))

“The changes will be broad, sweeping and significant,” Lake said. “The people who will be most affected are those who can least afford to be and access to credit will be harder to come by.”

This is not the first time banks have said they will pass on higher costs to consumers when regulators have tried to cap their fees. In 2010, following the post-financial crisis overhaul of banking regulations, lenders warned they would impose fees on debit cards because of a cap on some card fees — but few ended up doing so because consumers threatened to move business. Theirs. Some consumer advocates say this time is no different.

“Banks say their only option is to pass their costs on to customers, but that’s not true,” said Dennis Kelleher, president of Better Markets, an economics think tank that favors the proposed banking regulations. “Once again, banks are dressing up their efforts to maximize their profit under the guise of what is good or bad for customers.”

TWO-THIRDS OF AMERICANS ARE FALLING BACK, CAN’T KEEP THEIR DEFENSE

| TICKER | Safety | The last | AmENdmENT | change % |

|---|---|---|---|---|

| PYPL | PAYPAL HOLDINGS INC. | 59,76 | +0.12 | +0.20% |

Banks say this time may be different because of the scale of new financial regulations coming out of Washington. Agencies such as the Consumer Financial Protection Bureau are proposing an $8 limit on late credit card fees and a $3 limit on bank overdrafts. They are also planning to further limit debit card fees and how much software companies like Venmo and CashApp can charge for accessing and using their customers’ data. In addition, new bank capital rules would make it harder for banks to lend by requiring them to hold more reserves against mortgages and credit card loans.

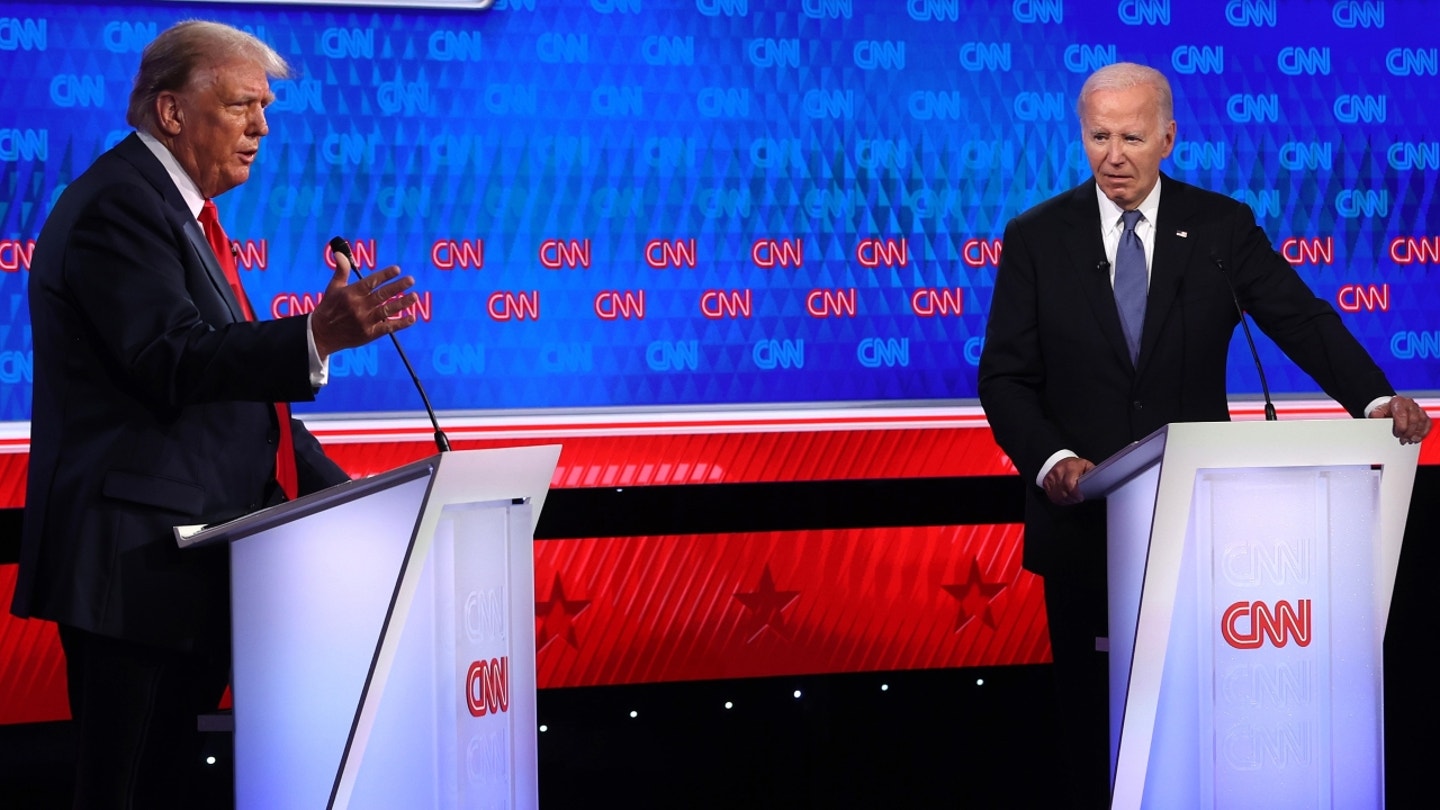

US President Joe Biden (R) and Republican presidential candidate former US President Donald Trump attend the CNN Presidential Debate at CNN Studios on June 27, 2024 in Atlanta, Georgia. President Biden and former President Trump are (Photo by Justin Sullivan/Getty Images / Getty Images)

It is possible that some of the rules could be weakened, or not become law at all, if Donald Trump takes the White House in November. But as the landscape stands now, Lake said many of the kinds of basic services Chase customers are used to — including free checking accounts, credit score trackers and financial planning tools — likely won’t be free anymore. .

Jamie Dimon, CEO of JPMorgan Chase, testifies during a Senate Banking, Housing and Urban Affairs Committee hearing titled “Annual Oversight of Wall Street Firms,” in the Hart Building on Wednesday, Dec. 6, 2023. (Tom Williams/CQ-Roll Call, Inc via Getty Images / Getty Images)

Long considered one of the two front-runners to succeed Jamie Dimon as chief executive when he retires, Lake has worked in many parts of JPMorgan Chase. She served as CFO between 2013 and 2019 and controller for its investment bank between 2007 and 2009.

She said she has seen how adjusting debit card swipe fees has made some banking services more expensive for customers, and she expects that to happen again.

“It’s not practical for many of the services to be free if we’re not going to be able to make a profit out of those pools,” Lake said.

Banks across the board have launched a series of appeals and taken the government to court to stop a raft of future rules. Most of the lawsuits have been filed in the Northern District of Texas, a favorite jurisdiction of institutions trying to stop rules and regulations promulgated by the Biden administration.

The rule limiting credit card late fees was approved by the CFPB in March, but then a coalition of banking industry groups sued to stop it before it became law. The law is pending appeal before a judge. Trade organizations representing big banks also sued to prevent changes to the Community Reinvestment Act, which requires banks to offer their services to low-income and historically disadvantaged communities.

Although the credit card late fee cap has not yet become law, some credit card companies are ready to pass the costs on to customers. Chase has outlined plans to raise interest rates and take a more conservative approach to credit card underwriting, according to an investor presentation.

In the long run, big banks like Chase could be the winners if the rules out of Washington are adopted.

| TICKER | Safety | The last | AmENdmENT | change % |

|---|---|---|---|---|

| BAC | BANK OF AMERICA CORP. | 40.41 | -0.49 | -1.20% |

| WFC | WELLS FARGO & CO. | 59,62 | -1.04 | -1.71% |

| C | CITIGROUP INC. | 64.03 | -0.43 | -0.67% |

“Any change in regulation that will limit fees will create opportunities for institutions that are very efficient,” said Dan Goerlich, a consulting partner at PricewaterhouseCoopers who advises banking clients. “Big banks can offset a decline in consumer banking revenue with gains from their wealth management and investment banking arms. Smaller and regional banks will struggle to make up for it.”

CLICK HERE TO READ MORE ABOUT FOX BUSINESS

But he warned that it may not be so easy for banks to pass on the costs either.

The highly competitive environment for retail deposits means that banks may end up needing to keep the services free, regardless of what the final rules look like.

“Most customers can access retail banking easily and seamlessly today,” Goerlich said. “It may be disadvantageous to maintain zero-cost services, but banks’ hands may be forced by other competitors who will offer customers low-cost services.”

Email Alexander Saeedy at alexander.saeedy@wsj.com