Really support

independent journalism

Our mission is to provide unbiased, fact-based reporting that holds the power to account and exposes the truth.

Whether it’s $5 or $50, every contribution counts.

Support us in providing journalism without an agenda.

According to the latest figures from the Department of Education, nearly 20 million people with student debt are defaulting on their payments.

After a three-year suspension of payments that began in 2020 during the pandemic, the government has resumed collecting the $1.6 trillion it is owed.

At the end of March, six months after the end of the pause, nearly 20 million borrowers were making payments on schedule. However, almost 19 million were not, leaving their accounts late, absent or still on hold.

Seven million people were at least 30 days late on payments at the end of 2023 – marking the highest delinquency rate since 2016.

Millions more had their accounts frozen through deferment or forbearance — meaning they didn’t have to pay back their loans or didn’t receive interest — while nearly six million student loans were still in default since before the pandemic. For most federal student loans, you default if you haven’t made a payment in more than 270 days.

“The default rate is really emblematic of a system that’s not doing its job,” said Persis Yu, managing counsel for the Student Borrower Advocacy Center. New York Times.

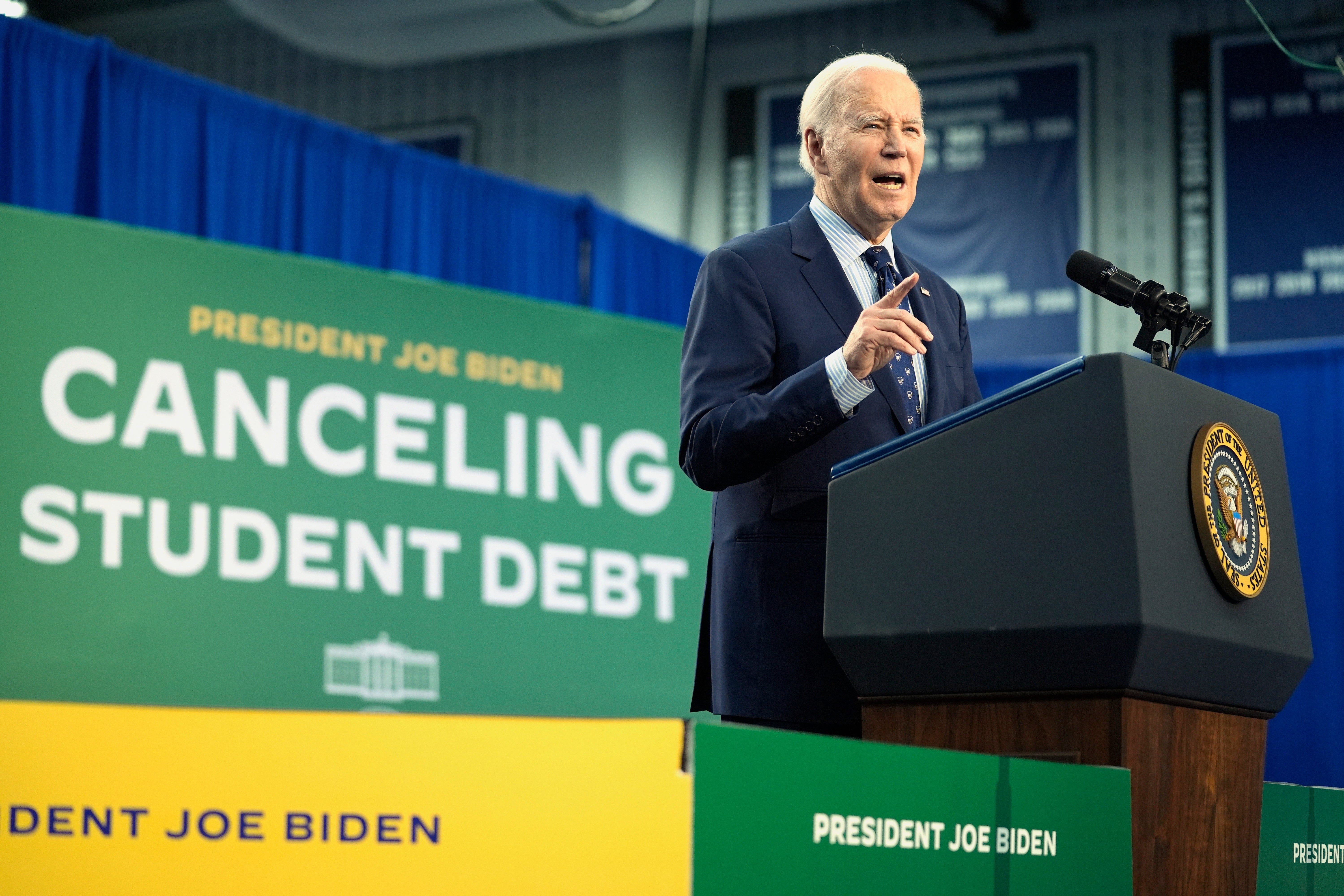

Throughout his presidency, Biden has sought to eliminate student debt, presenting a major proposal to cancel up to $400 billion in loans. This proposal was struck down by the Supreme Court, which ruled that the measure was unconstitutional.

President Biden also created the SAVE plan last year, which includes canceling up to $10,000 in federal student loan debt for borrowers earning less than $125,000 a year.

The plan includes reforms to income-driven repayment plans, lowering the percentage of discretionary income borrowers must pay each month from 10 percent to 5 percent. In addition, the proposal aims to protect more income from being taken into account in repayment calculations and forgive loan balances after 10 years of payments for those with loan balances of $12,000 or less.

Two coalitions of Republicans filed suit against SAVE, accusing the president of “unilaterally trying to impose an extremely expensive and controversial policy that he couldn’t get through Congress.”

Last week, federal judges in Kansas and Missouri temporarily blocked elements of the SAVE program, ruling in favor of states that challenged the president’s authority to impose such generous terms without congressional approval.

In the Kansas lawsuit, the states called the president’s debt relief maneuvers “a product of a rush to do evasively what the Supreme Court already told the defendants they could not do.”

But on Sunday, the 10th Circuit Court of Appeals temporarily overturned the Kansas decision, clearing the way for the Department of Education to proceed with planned payment cuts this month for millions of borrowers.

After the ruling, Education Secretary Miguel Cardona said the court “stands with student loan borrowers across the country who will benefit from the SAVE Plan – the most affordable repayment plan in history.”

The White House has said that more than 20 million borrowers could benefit from the SAVE plan. The administration said in May that 8 million have already signed up, including 4.6 million whose monthly payments have been reduced to $0.

More than one in 10 Americans has federal student debt.