Nvidia it was THE Artificial intelligence (AI) stocks to own over the past year and a half. However, the expectations built into the stock are surprising and could spell disaster in the future.

Still, AI is here to stay, and if you’re looking to invest in the sector, I’d consider these stocks before considering Nvidia.

Semiconductor Taiwan

Semiconductor manufacturing in Taiwan (NYSE: TSM) makes many of the chips that go inside all the devices that power the incredible AI technology in use today. With Nvidia’s GPUs packed full of TSMC products, it’s also benefiting from its performance.

Another big customer is Apple, which recently announced that its AI offering was only available on the latest generation of phones. This could spark a huge refresh wave, benefiting Taiwan Semi tremendously.

Regardless, management projects AI-related revenue to grow at a compound annual rate of 50% over the next five years, when it expects this segment to account for more than 20% of overall sales. Over the long term, management expects overall revenue growth of 15% to 20%, which would result in massive market outperformance.

Although Taiwan Semi’s stock has had a great run this year (it’s up over 75%), I believe this rally could continue for years to come as its products are integrated into a world that has barely scratched the surface of its capabilities. HE.

Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is the parent company of Google, which has long been a proponent of AI. While he seemed caught off guard by the surge in AI generative popularity in late 2022, his recent launches have rectified that mistake, and his Gemini model has emerged as a top choice.

Alphabet has also integrated AI into various advertising products, allowing advertisers to create effective campaigns and ensuring that its internal models match the right ad with viewers. While these releases haven’t directly translated into a massive increase in revenue, they have solidified Alphabet’s top spot among the countries advertisers should spend with.

While Alphabet won’t be as attractive an investment as Nvidia, it will consistently outperform the market by several percentage points each year thanks to its dividend, aggressive share repurchase plan, and steady growth.

The stock trades for about 25 times forward earnings, so it’s not historically cheap, but it’s significantly less expensive than many of its peers.

Salesforce

Salesforce (NYSE: CRM) it’s a bit of an afterthought, since it’s a customer relationship management software company. However, it is heavily pushing its AI model to its customers as a way to improve their businesses. It can be integrated internally to provide employees with the best possible information when closing a sale, thanks to heavy reliance on internal customer data. It can also create AI chatbots that provide better customer service interaction than has historically been available.

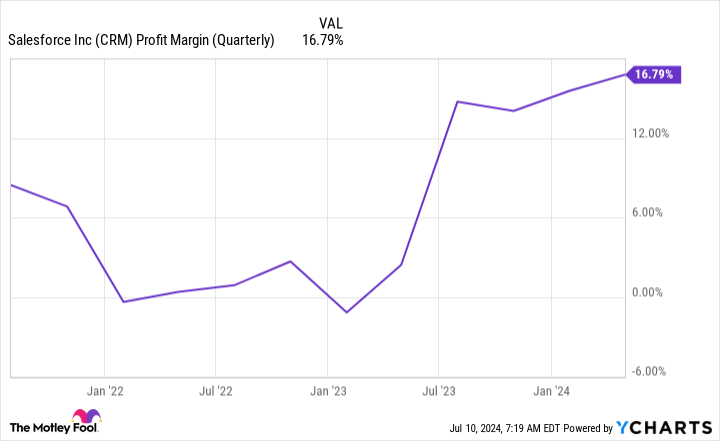

With Salesforce’s market position, getting this AI offering right is key to maintaining its market dominance. It also provides another growth lever for the company as its maturity is starting to show, with revenue only growing in the high single digits.

However, it recently initiated a dividend and still has a ways to go before it reaches the software company’s maximum profit margins (the gold standard is Adobemargin of 30%).

All of this adds up to great upside for the stock and could be a long-term market beater.

All three companies are more stable than Nvidia, which has exhibited a cyclical nature throughout its existence. Picking Alphabet, Taiwan Semiconductor and Salesforce is a smart idea if you’re looking for more reasonably priced stocks with strong growth potential.

Should You Invest $1000 in Semiconductor Manufacturing in Taiwan Now?

Before you buy shares in Taiwan Semiconductor Manufacturing, consider this:

of Motley Fool Stock Advisor the team of analysts just identified what they believe they are Top 10 Stocks for investors to buy now… and Taiwan Semiconductor Manufacturing was not one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you would have $791,929!*

Stock advisor provides investors with an easy-to-follow plan for success, including instructions for building a portfolio, regular updates from analysts, and two new stock picks each month. of Stock advisor the service has more than quadrupled return of the S&P 500 since 2002*.

See 10 shares »

*The stock advisor returns as of July 8, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Adobe, Alphabet, Salesforce and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Adobe, Alphabet, Apple, Nvidia, Salesforce and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Forget Nvidia: 3 Artificial Intelligence (AI) Stocks to Buy Now was originally published by The Motley Fool