Shares of Nike (NYSE: NKE) plunged after the athletic apparel and footwear company disappointed investors by predicting a surprise drop in sales for fiscal 2025. Shares are now down about 30% from last year.

These recent losses have extended Nike’s decline since the stock hit its peak in 2021, and shares have fallen about 10% over the past five years.

Let’s take a look at Nike’s most recent quarterly results and the issues it faces to determine if this is a buying opportunity.

Amazing instructions

For its fiscal 2024 fourth quarter (ended May 31), Nike’s sales fell 2% year over year to $12.6 billion. Nike brand revenue fell 1% to $12.1 billion, while Converse sales fell 18% to $480 million.

From channel sales, Nike’s direct revenue fell 8% to $5.1 billion and wholesale revenue rose 5% to $7.1 billion. However, the company still managed to expand its gross margin by 110 basis points to 44.7%, helped by lower ocean freight costs and price changes. Management also reduced operating expenses with selling, general and administrative (SG&A) costs falling 7%.

As a result, earnings per share (EPS) rose 50% to $0.99, despite the overall decline in sales. Inventories, meanwhile, fell 11% year over year to $7.5 billion.

While the quarterly results were mixed, it was the guidance that shocked investors.

The company now expects fiscal 2025 sales to fall by a mid-single digit, reversing CFO Matt Friend’s comments from the March earnings call, when he said sales “will impact the second half and grow next year on the main line”.

For the fiscal first quarter, management is guiding revenue to fall 10% year over year “with the first half in the low high single digits.”

The company blamed challenges in its direct business, a weak wholesale order book, a softer China and aggressive actions it is taking to manage its classic shoe franchise. It sounds like almost every segment across Nike is experiencing issues, and these issues are spread across multiple geographies as well.

On the bright side, the company is looking for its gross margin to expand 10 to 30 basis points for the year, and its inventory position looks quite manageable. This should not be overlooked because when apparel and footwear companies encounter sales problems, it can often be exacerbated by inventory and gross margin issues.

Is this an opportunity to buy shares?

Nike is an iconic brand, although it’s clear that it has run into problems in recent years. The company hopes to revive growth through product innovation and has always been a marketing machine.

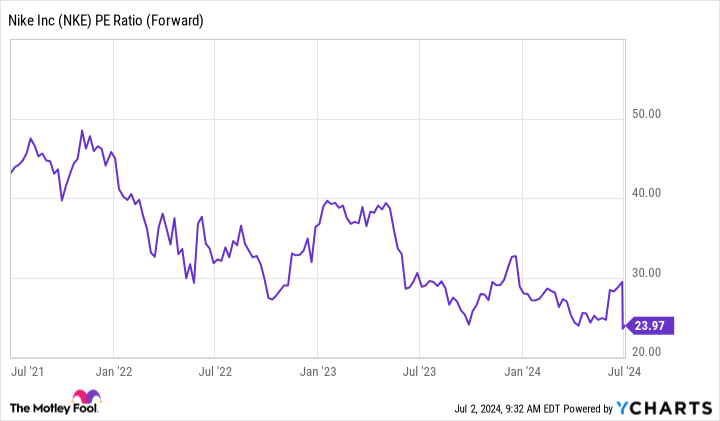

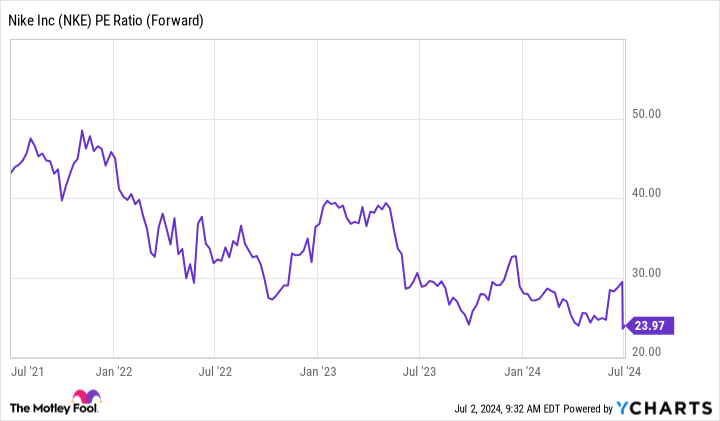

From a valuation standpoint, the company now trades at a price-to-earnings (P/E) ratio of 24. Nike has generally traded at a premium to the broader market given the strength of its brand. However, for a company with a shrinking top line, its valuation looks frothy at the moment.

Overall, Nike should be able to turn its fortunes around, but given the difficulty the company has had forecasting its business, shareholders should expect increased volatility from the stock, especially around its earnings reports.

If the valuation falls further, I will pick up the stock. Until then, investors should keep Nike on their watch lists.

Should you invest $1,000 in Nike right now?

Before you buy Nike stock, consider this:

of Motley Fool Stock Advisor the analyst team just identified what they believe they are Top 10 Stocks for investors to buy now… and Nike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you would have $761,658!*

Stock advisor provides investors with an easy-to-follow plan for success, including instructions for building a portfolio, regular updates from analysts, and two new stock picks each month. of Stock advisor the service has more than quadrupled return of the S&P 500 since 2002*.

See 10 shares »

*The stock advisor returns as of July 2, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions and recommends Nike. The Motley Fool recommends the following options: long January 2025 $47.50 Nike calls. The Motley Fool has a disclosure policy.

Nike shares sank on disappointing guidance. Is this a Slam Dunk opportunity to buy the stock? was originally published by The Motley Fool