Rep. Virginia Foxx, RN.C., says students will borrow more in the future, thinking taxpayers will pay for it in “Evening Editorial.”

Student loan borrowers in the US are taking their time to resume repayments after the last pandemic-related pause expired late last year.

Repayments were halted for federal student loan borrowers from mid-March 2020, when the COVID pandemic began, and remained in effect until September 1, 2023, 3 1/2 years after the repayment pause began.

Data from the Department of Education shows that, as of the end of March 2024, almost 20 million borrowers had resumed making payments on their student loans, while roughly 19 million had not, leaving their accounts in a delinquent state. , non-payment. or else has been terminated through procrastination or forbearance, The New York Times reported.

Borrowers have until September to take advantage of the so-called ramp that allows them to stop making payments without reporting defaults to the credit bureaus. Although, their accounts continue to accrue additional interest while the ramp is in effect.

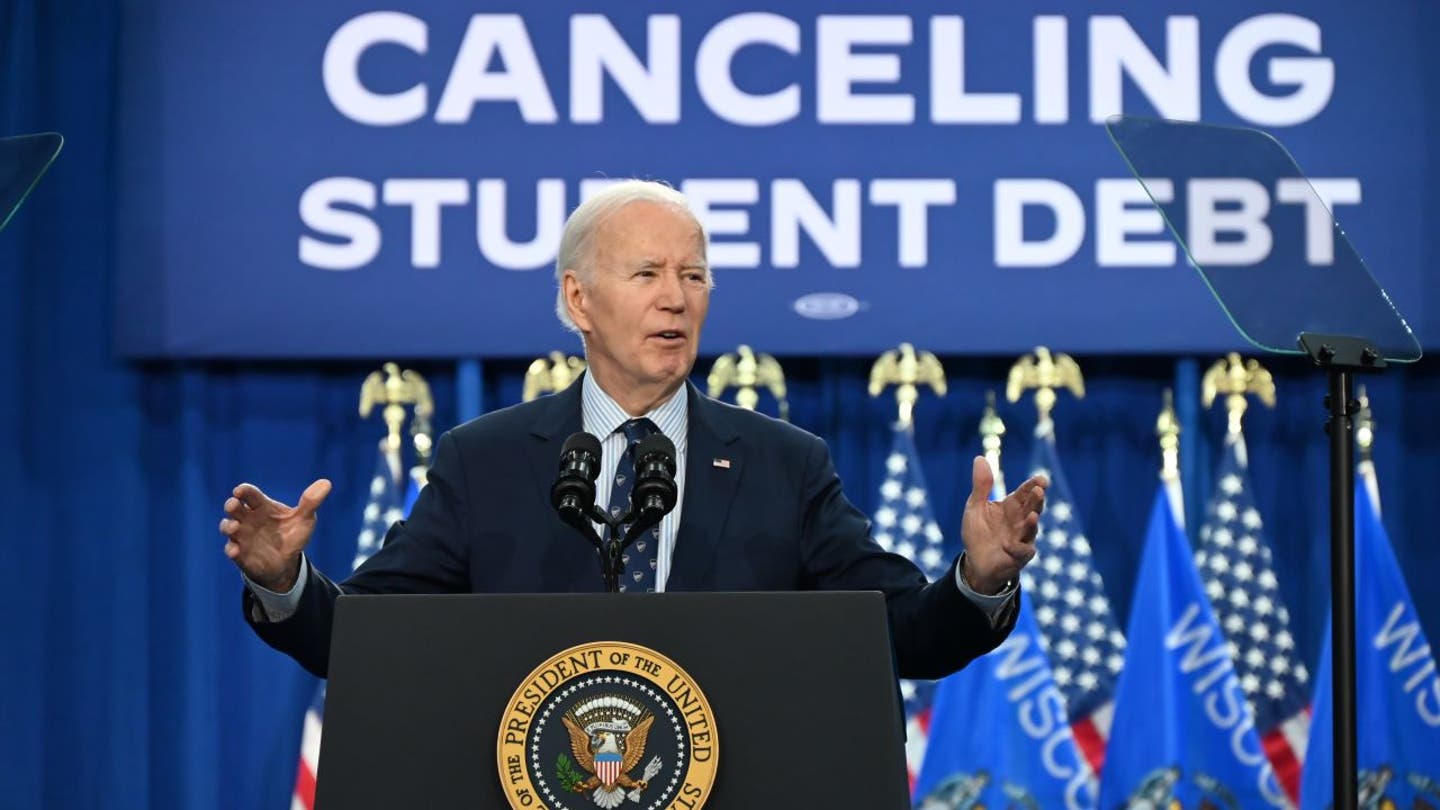

BIDEN’S STUDENT DEBT PLAN COULD COST $1.4 TRILLION

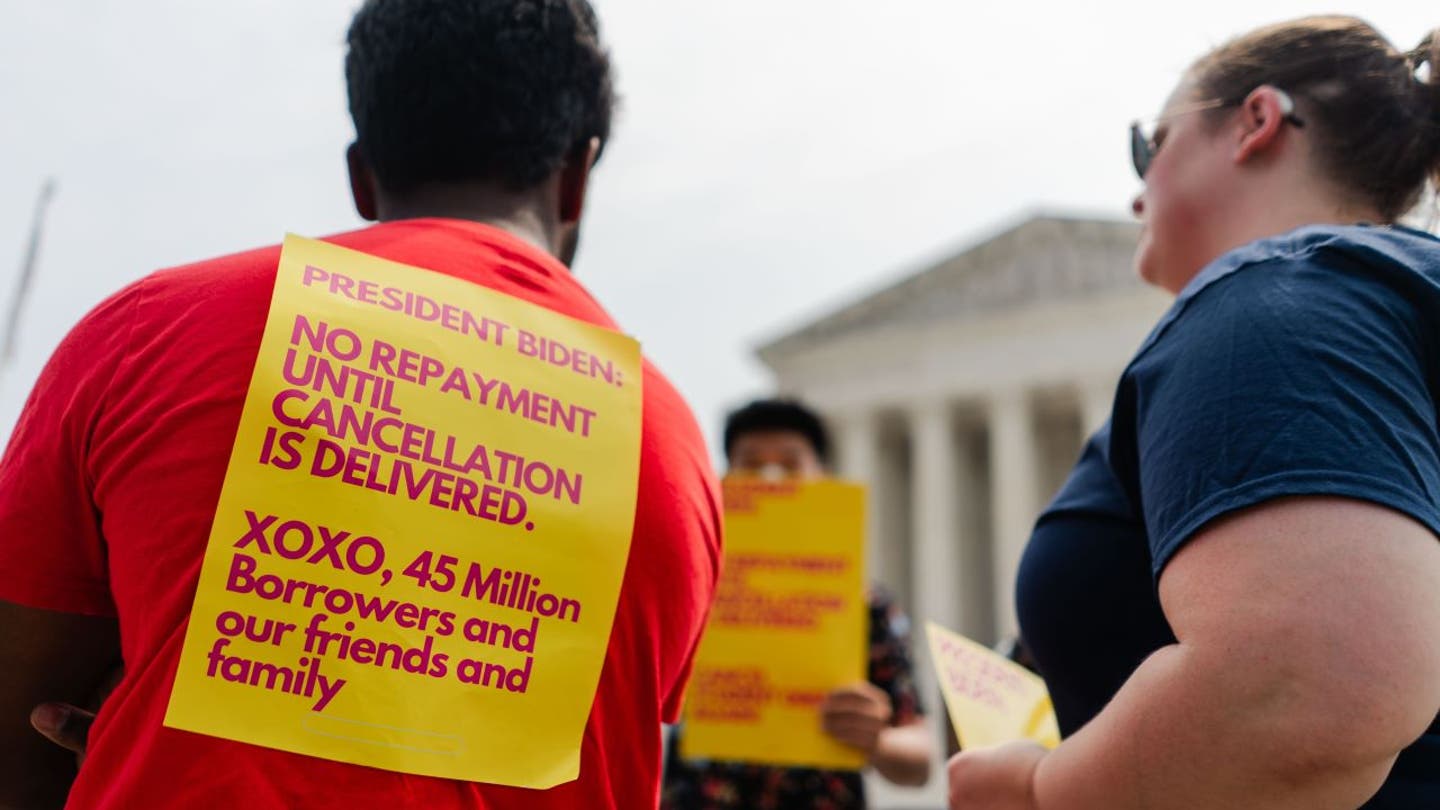

Some student loan borrowers have lobbied the Biden administration to write off as much student loan debt as possible, despite courts rejecting some of the president’s proposals. (Kent Nishimura/Los Angeles Times via Getty Images/Getty Images)

The data showed that 42.8 million federal student loan borrowers owed a total of $1.62 trillion as of the end of March.

The number of borrowers fell to its lowest level since the third quarter of 2022, amid President Biden’s student loan plans that have sought to cancel or reduce outstanding balances for borrowers.

Several iterations of Biden’s student loan debt cancellation plans have been rejected or put on hold by federal courts, prompting the administration to explore different ways to approach the issue that could pass legal muster.

GEN X, BOOMER AMONG STUDENT LOAN BORROWERS HOLDING THE MOST: REPORT

President Biden has announced several efforts to cancel student loan debt or provide relief to borrowers, some of which have been blocked by the courts. (Kyle Mazza/Anadolu via Getty Images/Getty Images)

The Biden administration’s new revenue-driven repayment program (IDR), known as the Savings on a Value Education (SAVE) plan, was the latest version to run into legal trouble.

Last week, a federal court in Missouri stopped the Biden administration by granting additional forgiveness to borrowers under the SAVE plan.

or federal judge in Kansas also found the SAVE Plan illegal last week, though that ruling was stayed by a federal appeals court on Tuesday, allowing the Department of Education to continue cutting payments under the plan.

GET FOX BUSINESS IN ALBANIA by clicking HERE

Nearly half of student loan borrowers have not resumed repayment since the pause ended. (Kent Nishimura/Los Angeles Times via Getty Images/Getty Images)

Announced in 2023, the SAVE Plan modified and replaced the previous IDR plan called the RIPAYE Plan. Under the SAVE plan, borrowers’ monthly payments are calculated based on their income and family size. It lowers payments for nearly all borrowers while granting forgiveness to borrowers who originally took out $12,000 or less in loans after 10 years.

It also includes an interest benefit for borrowers who make the full monthly payment but the amount is not enough to cover their accrued monthly interest. The federal government pays for the remainder of the accrued interest that month on the schedule. So, in effect, this provision prevents balances from growing due to unpaid interest.